jones county tax assessor's office

Suite 120 Norman OK 73069. Although county tax offices provide services on behalf of TxDMV operational decisions are made independently at the county level.

Documents Suggest Favoritism On San Diego County Property Tax Appeals By Assessor S Office

The County Clerk will begin to accept online appointments for in-person marriage ceremonies today and marriage ceremonies no more than six guests will resume after City Hall reopens.

/cloudfront-us-east-1.images.arcpublishing.com/gray/RU23OQMQLBAWTNN3GCNRHNCZA4.jpg)

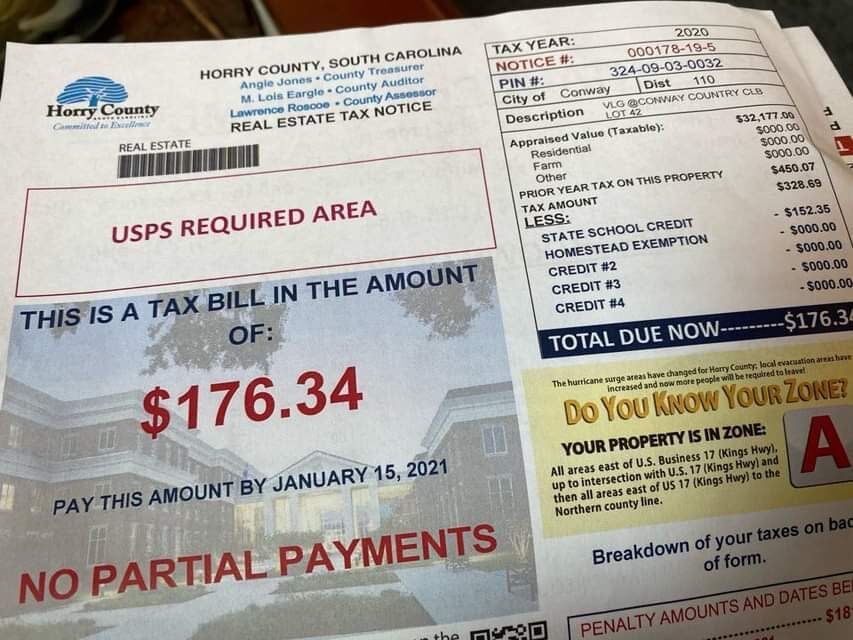

. Obtain a vehicle tax notice from the Horry County Auditors Office. Prior to that time the duties pertaining to the office were primarily performed by the clerk of the circuit court. Early history shows that the office of county auditor was first created by an act of the legislature in 1841.

Applications for tax exemptions are available from the Cook County Assessors Office. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. The Assessors office has the responsibility to assess all property in the City at 50 of fair market value.

This includes homes factories commercial properties vacant land and personal property. The County Auditor is a statutory office created by the Indiana General Assembly and is elected every four years. Counter services will be open for the Treasurer and Tax Collectors Office the Assessors Office County Clerk Office of Small Business and other agencies.

Pay the tax notice in person at the Horry County Treasurers Office with check or money order payable to Horry County Treasurer cash or VisaMasterCardAmerican Express. Email Douglas Warr Website. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

Those homeowners received the Senior Citizen Homestead Exemption for Tax Year 2018 but did not reapply for Tax Year 2019 due in 2020. Kane County collects on average 209 of a propertys assessed fair market value as property tax. The Cherokee County Juvenile Court is dedicated to serving the residents of Cherokee County by hearing all cases involving allegations of dependency of children under the age of eighteen delinquency and traffic violations concerning children under the age of seventeen and Children in Need of Services cases found within its jurisdictions.

Of those seniors roughly 20000 previously received the Senior Freeze Exemption but also did not reapply. Convenience fees apply to all tax payments made with a credit or debit card. If the Assessor.

Some county tax offices are now open while others remain closed to the public but continue to process certain transactions. The 2021 tax year exemption applications are now available. As a reminder many exemptions automatically renew this year due to COVID-19.

Assessor Fritz Kaegi announces that property-tax-saving exemptions for the 2021 tax year are now available online in a new streamlined application. Contact your county tax office directly for the current status of their offices and services. To meet the standards of the State Tax Commission the Assessors office reviews a portion of the properties every year.

Government Center Closed To Public Again Jones County News

General Information Jones County Board Of Tax Assessors

Horry County Rethinks Its Tax Notices In An Effort To Save Taxpayer Money Myrtle Beach Postandcourier Com

North Carolina Tax Assessors Your One Stop Portal To Assessment Parcel Tax Gis Data For North Carolina Counties

Clark County Assessor S Office To Mail Out Property Tax Cap Notices Klas

Jones County Tax Assessor Collector Laurel Ms Government Organization Facebook

About The Auditor Jones County Iowa

Property Tax Statements To Be Mailed Sept 13 Gainesville Times

About The Auditor Jones County Iowa

Jones County Assessment Notices Reflect Increased Housing Market Jones County Iowa

Jones County Supervisors Vote In Pay Raise Effective In January News Impact601 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/COVPMD3CWBHFTA3MJTN3AKRZTE.jpg)

Homestead Exemption Season Has Begun

Frequently Asked Questions Jones County Ms

Reappraisal Committee S Appraisal Survey Ended With 1 200 Participants

We Recommend Ann Harris Bennett For Tax Assessor Collector And Voter Registrar In The Democratic Primary Editorial

/cloudfront-us-east-1.images.arcpublishing.com/gray/RU23OQMQLBAWTNN3GCNRHNCZA4.jpg)

Forrest County Tax Assessor Announces Homestead Exemption Deadline